What Down Payment and Credit Score Are Needed for a DSCR Loan in Colorado?

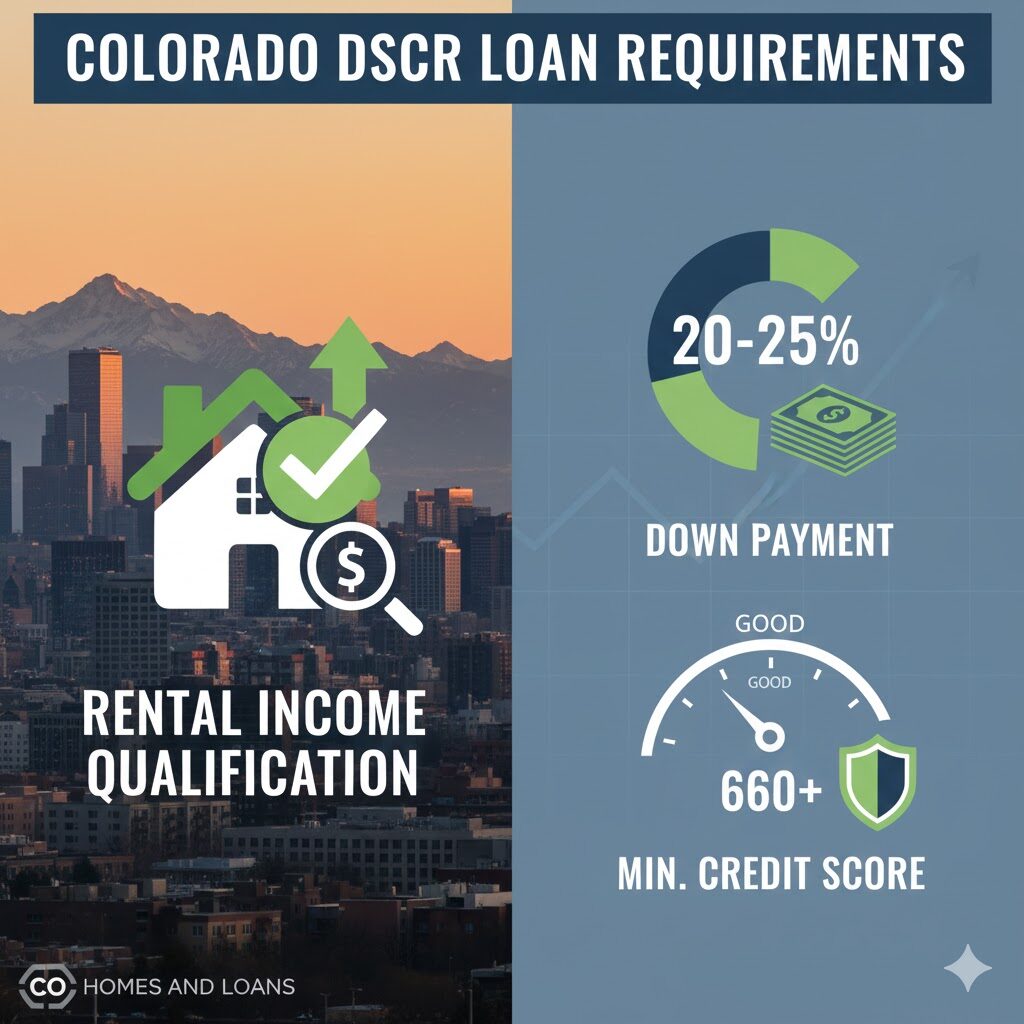

A common question from real estate investors exploring DSCR loan down payment and credit score requirements is how much money is needed upfront and what credit score lenders typically look for. DSCR loans are designed to be flexible, but there are still standard guidelines investors should understand before getting started.

DSCR loans qualify borrowers based on the rental income of the property rather than personal income, which makes them popular with investors across Centennial, Denver, Parker, Castle Rock, and surrounding Colorado communities.

Typical Down Payment Requirements for DSCR Loans

Most DSCR loan programs require a down payment between 20 and 25 percent of the purchase price. The exact amount depends on several factors, including the property type, the borrower’s credit profile, and the strength of the property’s cash flow.

Single-family rental properties with strong rental income often fall closer to the lower end of that range, while multi-unit or short-term rental properties may require a larger down payment. These requirements reflect broader investment property risk guidelines outlined in housing finance education from the Consumer Financial Protection Bureau, which explains how lenders evaluate mortgage risk.

Higher down payments can sometimes result in more favorable loan terms, but the primary focus remains on whether the property can support its own debt through rental income.

Credit Score Guidelines for DSCR Loans

Credit score requirements for DSCR loans are generally more flexible than traditional investment loans. Most programs start with minimum credit scores in the mid-600s, with many lenders preferring scores of 660 or higher.

Borrowers with stronger credit profiles may have access to better pricing or additional program options, but DSCR loans do not rely on income-to-debt ratios the way conventional loans do. This makes them attractive for investors who manage their taxable income strategically, a practice recognized by the IRS through depreciation and rental expense guidelines.

How Credit and Down Payment Work Together

Down payment and credit score are evaluated together, not in isolation. A borrower with a higher credit score and strong reserves may have more flexibility, while a lower credit score may require a higher down payment to offset risk.

Lenders also review assets, reserves, and overall credit history, not just the score itself. The goal is to ensure the borrower is well-positioned to manage the investment property long term.

How DSCR Loans Differ From Conventional Investment Loans

Unlike conventional investment loans backed by Fannie Mae and Freddie Mac, DSCR loans fall into the non-QM category. Conventional programs typically require higher documentation standards and rely heavily on personal income calculations.

DSCR loans, by contrast, focus on rental income and property performance, which can be a better fit for investors looking to scale beyond traditional financing limits.

Next Steps for Investors Exploring DSCR Loans

If you are considering a DSCR loan in Colorado and want clarity around DSCR loan down payment and credit score requirements, reviewing your specific property and credit profile is the best next step. Each scenario is unique, and small details can influence final terms.

If you would like to review a potential investment property or discuss DSCR loan options, reach out at rbaxter@choicemortgage.com or call (303) 670-0137.

For more educational articles on investment property financing and mortgage options in Colorado, visit https://www.cohomesandloans.com/blog.