Mortgage Planning for the Year Ahead: A 2026 Roadmap from a Local Mortgage Broker

If the last few years in the real estate market have taught us anything, it is that preparation is the ultimate currency. As we look toward the horizon of 2026, the housing market in Centennial, Colorado, and the broader Denver metro area continues to evolve. Whether you are a first-time homebuyer looking to plant roots, a seasoned homeowner considering a move-up purchase, or an investor eyeing the next opportunity, success starts with a plan.

At Choice Mortgage Group – RJ Baxter Team, we believe that a mortgage isn’t just a transaction; it is a pivotal piece of your overall financial puzzle. We don’t just quote rates; we build roadmaps. This guide is designed to help you navigate the mortgage landscape for the year ahead, providing actionable insights to ensure you are financially ready to strike when the right property hits the market.

Why You Need a Mortgage Strategy for 2026

Many potential buyers make the mistake of waiting until they find the perfect house to think about financing. In a competitive market like Centennial, that strategy can lead to heartbreak. By 2026, market dynamics regarding interest rates, inventory, and lending guidelines will likely shift again. Establishing a relationship with a local mortgage broker now puts you in the driver’s seat.

Strategic mortgage planning involves analyzing your debt-to-income ratio, understanding the nuances of credit reporting, and identifying the specific loan program that aligns with your long-term wealth goals. It is about moving from “Can I qualify?” to “How does this loan benefit my financial future?”

The “Local” Advantage in Centennial

Why choose a local lender over a national call center? Real estate is hyper-local. As a team based right here in the community, we understand the specific contract deadlines common in Colorado, the nuances of local HOA certifications, and the reputation required to get your offer accepted by listing agents. When a listing agent sees a pre-approval letter from Choice Mortgage Group – RJ Baxter Team, they know the deal is solid because we are known for our high level of communication and follow-up.

The 2026 Real Estate Outlook: A Centennial Perspective

While no one has a crystal ball, data trends allow us to forecast the environment for 2026. Centennial and the surrounding Denver suburbs have remained resilient. We anticipate a market that continues to value turn-key properties, with a stabilizing inventory that offers buyers slightly more leverage than the frenzied years of the past.

However, affordability remains a key conversation. This is why our team focuses on creative financing solutions. Whether it is utilizing temporary rate buydowns to lower initial payments or looking at adjustable-rate mortgages (ARMs) as a strategic bridge, we help you navigate the numbers so you can comfortably afford the home you love.

Step 1: The Financial Health Checkup

Before you start browsing listings online, we need to look under the hood of your finances. Here is what we look for when building your 2026 roadmap:

- Credit Precision: It’s not just about having a “good” score. We analyze your report to see if paying down a specific credit card balance could bump you into a better interest rate tier. We offer advice on how to optimize your score months in advance.

- Income Documentation: Are you self-employed? Do you earn commissions or bonuses? Lending guidelines for variable income can be complex. We review your tax returns and pay stubs early to ensure we calculate your qualifying income correctly.

- Asset Strategy: We help you determine where your down payment and closing costs will come from. Whether it is savings, a gift from family, or a 401(k) loan, sourcing these funds properly is critical for compliance.

If you are unsure where you stand, contact us today. We can run a soft credit check that won’t impact your score to give you a baseline.

Step 2: Choosing the Right Vehicle (Loan Options)

Not all mortgages are created equal. Depending on your down payment capabilities and military service history, different loan types offer distinct advantages. Here is a quick comparison of the loan options we frequently structure for our Centennial clients:

| Loan Type | Best For | Key Benefit | Down Payment |

|---|---|---|---|

| Conventional | Borrowers with good credit (620+) | Flexible terms, no mortgage insurance with 20% down. | As low as 3% |

| FHA Loan | First-time buyers or lower credit scores | More lenient on credit and debt-to-income ratios. | 3.5% |

| VA Loan | Veterans and active military | No mortgage insurance and often lower rates. | 0% |

| Jumbo Loan | Luxury homes exceeding conforming limits | Financing for higher-priced properties in Centennial. | Usually 10-20% |

At the RJ Baxter Team, we take the time to explain these options in terminology you will understand—no complicated jargon. We want you to feel empowered, not overwhelmed.

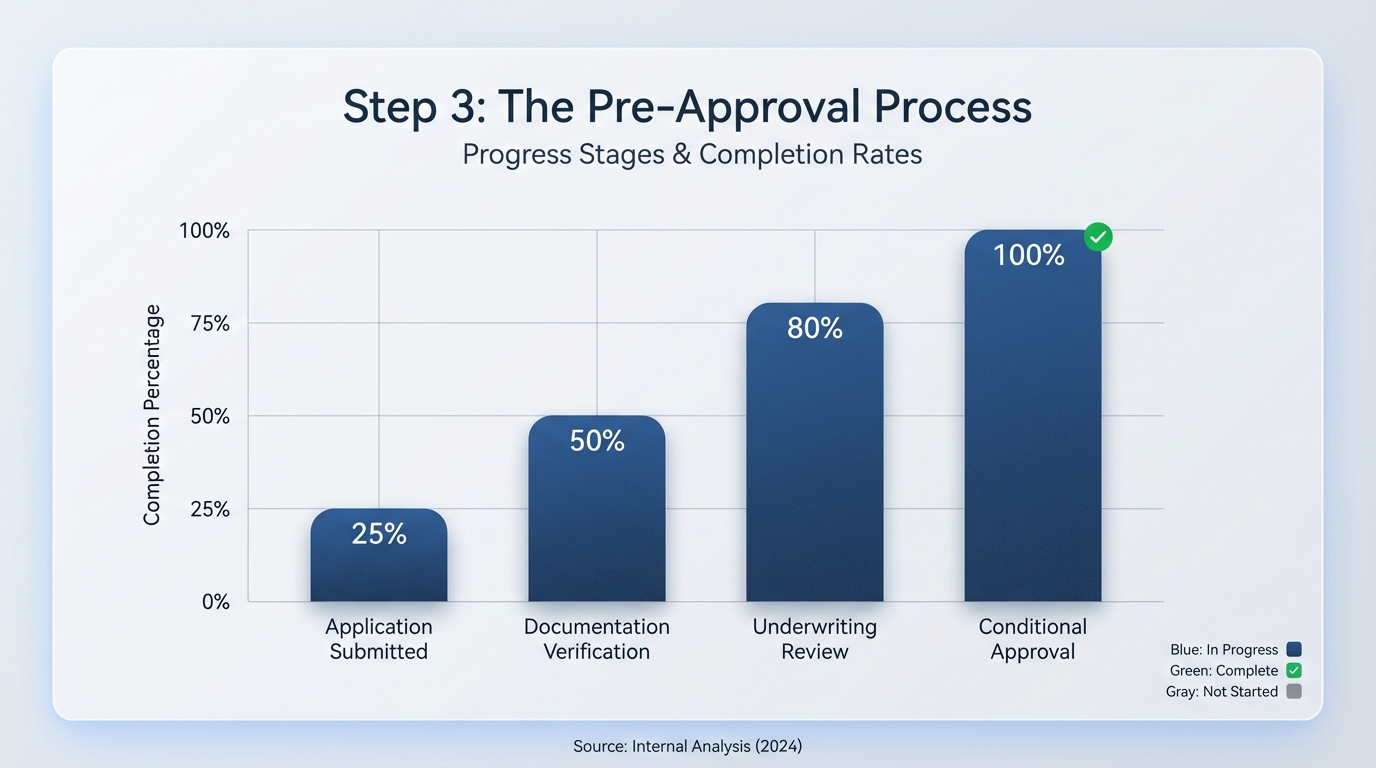

Step 3: The Pre-Approval Process

- Application: You complete our secure online loan application.

- Document Upload: You provide the necessary financial documents (W2s, bank statements, etc.).

- Analysis: Our team reviews your file with the eye of an underwriter.

- Strategy Call: We discuss your budget, monthly payment comfort zone, and issue your pre-approval letter.

Once you are pre-approved, we don’t disappear. We update your pre-approval letter as needed for specific offers and call the listing agent to vouch for your financial strength.

The Importance of Communication: The “Tuesday Update”

One of the biggest complaints we hear about other lenders is a lack of communication. You will never experience that with us. We have a strict protocol to ensure you are never left in the dark.

Our Promise: We provide a status update every single Tuesday. Whether your loan is in underwriting, waiting on an appraisal, or clear to close, you will hear from us. As our client Sheree Pinner noted, “RJ was very attentive and informative. I appreciated the ‘every’ Tuesday phone call.”

We treat every client like family. We know you don’t do this every day, so we are here to guide you through the process, answer your calls on evenings and weekends, and ensure a stress-free experience.

Refinancing in 2026: Is it Time?

For those who already own a home in Centennial, 2026 might be the year to optimize your current mortgage. If rates dip, or if your home equity has grown significantly, refinancing could unlock major financial benefits.

Reasons to Consider Refinancing:

- Lower Your Monthly Payment: Reduce interest costs and improve monthly cash flow.

- Cash-Out Refinance: Use your home’s equity to pay off high-interest credit card debt, fund home improvements, or pay for college tuition.

- Remove Mortgage Insurance: If you have an FHA loan or have reached 20% equity on a conventional loan, refinancing can eliminate PMI.

- Shorten Your Term: Switch from a 30-year to a 15-year mortgage to pay off your home faster.

Our team specializes in market trends and helps homeowners determine the exact right time to refinance. We run the numbers to ensure the tangible net benefit makes sense for you.

Navigating Interest Rate Volatility

Remember the saying: “Marry the house, date the rate.” If rates drop in the future, we will be the first to call you to discuss a refinance. If rates go up, you will be glad you locked in when you did. We offer “Lock and Shop” options and other tools to protect you from volatility while you search for a home.

Your 2026 Timeline: When to Start?

If you plan to buy a home in the spring or summer of 2026, here is a suggested timeline:

- 3-6 Months Before: Contact RJ Baxter for a consultation. Review credit and savings. Fix any errors on your credit report.

- 2 Months Before: Gather documents and get officially pre-approved. Connect with a real estate agent (we can refer you to top agents in Centennial).

- 1 Month Before: Start viewing homes and refining your criteria.

- When You Find the Home: Make an offer with confidence, knowing your financing is bulletproof.

Frequently Asked Questions (FAQs)

1. How much money do I really need for a down payment in Centennial?

Many buyers believe they need 20% down, but that is a myth. Qualified buyers can purchase a home with as little as 3% down for conventional loans, or 3.5% for FHA loans. Veterans can often buy with 0% down. We also have access to down payment assistance programs for eligible borrowers. We can help you calculate exactly how much cash you need to close.

2. What is the difference between a mortgage broker and a bank?

As a mortgage broker, Choice Mortgage Group works with multiple wholesale lenders. This allows us to “shop” your loan to find the best rate and product for your specific situation. Big banks often have a single set of products and stricter guidelines. We offer more flexibility, faster closing times, and personalized service that big banks simply cannot match.

3. How does my credit score affect my mortgage rate?

Generally, a higher credit score leads to a lower interest rate. Lenders use “risk-based pricing,” meaning they charge less to borrowers who have demonstrated a history of managing credit well. However, we have excellent loan options for borrowers with less-than-perfect credit. We can also perform a “what-if” simulator to show you how paying down certain debts might improve your score and your rate.

4. Can I buy a home if I am self-employed?

Absolutely. While self-employed borrowers have to provide more documentation (usually two years of tax returns), we are experts in analyzing self-employed income. We also have access to “Bank Statement Loans” where we qualify you based on your business cash flow rather than the net income shown on your tax returns.

5. How long does the mortgage process take?

On average, we can close a loan in 30 days or less. However, we are known for our speed and can often close faster if all documents are provided promptly. Our streamlined online application and dedicated team (including the wonderful Mary Jo!) ensure that your file moves through underwriting efficiently so you don’t miss your closing date.

Ready to Build Your 2026 Mortgage Plan?

Don’t leave your homeownership dreams to chance. The Centennial market rewards those who are prepared. At Choice Mortgage Group – RJ Baxter Team, we are dedicated to honesty, hard work, and responsiveness. We want to be your lender for life, guiding you through your first purchase, your refinance, and your eventual dream home.

Let’s start the conversation today. There is no obligation and no pressure—just expert advice to help you get where you want to go.

Contact RJ Baxter today:

Phone: (303) 670-0137

Email: rbaxter@choicemortgage.com

Website: www.cohomesandloans.com

Experience the difference of a lender who treats you like family. Call us anytime—evenings and weekends included!

Compliance Disclaimer: This blog post is for informational purposes only and does not constitute a commitment to lend or financial advice. Mortgage rates, terms, and programs are subject to change without notice and may not be available in all areas or to all borrowers. Choice Mortgage Group is an Equal Housing Lender. NMLS #395819. Please contact RJ Baxter for specific loan scenarios and current rate information.